To pay off debt strategically, start by listing all your debts with interest rates and balances. Choose a repayment method like avalanche or snowball, and dedicate a consistent amount each month. build an emergency fund and avoid new debt. Automate savings to reduce stress, and stay disciplined by resisting impulse spending. Staying flexible with your plan helps, and if you continue, you’ll discover more effective techniques to accelerate your progress.

Key Takeaways

- List all debts with interest rates and balances to prioritize repayment effectively.

- Choose a repayment strategy: avalanche (highest interest first) or snowball (smallest balance first).

- Allocate consistent monthly payments and adjust your plan as your financial situation changes.

- Use windfalls like bonuses or refunds to pay down debt and avoid unnecessary spending.

- Maintain disciplined spending habits and avoid new debt during repayment to stay on track.

Are you overwhelmed by debt and unsure where to start? Tackling debt can feel intimidating, but with the right approach, you can regain control and set yourself on a path toward financial freedom. The first step is developing effective saving strategies that can help you build a safety net while paying down what you owe. Instead of just focusing on eliminating debt, consider how small, consistent savings can reduce stress and prevent future financial setbacks. For example, automating a small transfer into a savings account each month ensures you’re always setting something aside, even when funds are tight. This habit not only provides peace of mind but also reinforces disciplined financial planning, which is vital for making steady progress.

When it comes to paying off debt, financial planning acts as your roadmap. Start by listing all your debts with their interest rates and balances. This clarity allows you to prioritize which debts to pay off first, whether by focusing on the highest interest rates (the avalanche method) or the smallest balances (the snowball method). Whichever strategy you choose, having a plan keeps you motivated and prevents aimless payments. Allocate a specific amount of your monthly income toward debt repayment—consistency is key. As you pay down balances, revisit your plan regularly to adjust for changes in income or expenses. Creating a realistic budget that accounts for your debt payments and savings goals helps you stay on track without sacrificing essential needs.

Incorporate your saving strategies into your overall financial plan. For instance, if you receive a bonus or tax refund, consider putting a portion toward debt repayment rather than splurging. Simultaneously, keep building your emergency fund to cover unexpected expenses, which can otherwise derail your repayment efforts. Remember, the goal isn’t just to pay off debt quickly but to develop sustainable habits that keep you financially healthy in the long run. Avoid the trap of accumulating new debt while paying off existing balances by being mindful of your spending and resisting impulse purchases. Think of your financial plan as a flexible but firm blueprint guiding your decisions—adjusting as needed but always moving toward your debt-free goal. Additionally, understanding debt management techniques can help you choose the most effective strategy for your situation.

Debt Repayment

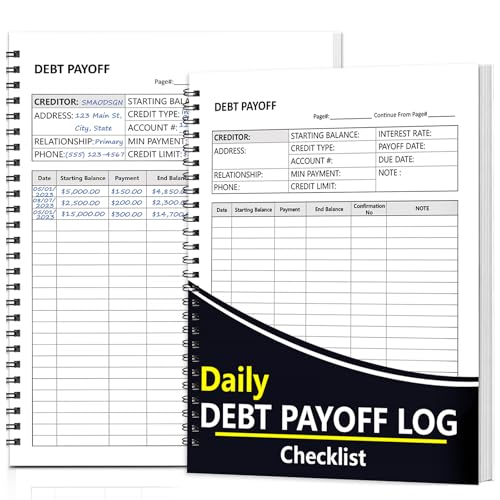

Debt management and repayment tool

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Frequently Asked Questions

How Can I Prioritize Which Debts to Pay off First?

When deciding which debts to pay off first, you should consider your options. With the debt avalanche, you focus on paying off the highest interest rate debts first, saving money over time. Alternatively, the debt snowball method encourages paying off the smallest balances first for quick wins and motivation. Choose the strategy that keeps you motivated and aligns with your financial goals to effectively reduce your debt.

What Is the Best Way to Avoid Accumulating More Debt?

Imagine your wallet as a garden; if you don’t tend to it, weeds of debt will overrun your space. To avoid more debt, cultivate smart financial habits and stay aware of your spending, like watering delicate plants. Keep track of every expense, set budgets, and prioritize needs over wants. This mindfulness creates a healthy financial environment, preventing new debts from sprouting and helping your money grow strong.

How Does Debt Consolidation Affect My Credit Score?

Debt consolidation can impact your credit score in various ways. If you use credit counseling wisely, it might improve your score by reducing your debt-to-credit ratio. However, applying for debt forgiveness or opening a new consolidation loan can cause a temporary dip due to hard inquiries. Be sure to weigh these effects, and consider consulting a credit counselor to develop a strategy that minimizes negative impacts while paying off your debt efficiently.

Are There Any Tax Implications When Paying off Debt?

When paying off debt, you should consider tax implications, especially regarding tax considerations like deductible interest. If you have mortgage or student loan debt, the interest you pay may be deductible, reducing your taxable income. However, not all debt offers deductible interest, so it’s crucial to review specific rules. Paying off certain debts might also impact your overall tax situation, so consult a tax professional to understand the benefits and potential drawbacks.

What Strategies Work Best for Paying off High-Interest Debt Quickly?

Imagine slicing through debt like a hot knife through butter—that’s what debt snowball and debt avalanche strategies aim for. With the debt snowball, you pay off smallest balances first, gaining momentum and motivation. The debt avalanche targets highest-interest debts, saving you money faster. For quick results, focus on the debt avalanche, but if motivation wanes, switch to snowball. Both methods clear high-interest debt efficiently when used consistently.

100 Envelope Savings Challenge Binder,with Password Lock,Money Saving Binder Book,Cash Envelopes for Budgeting,Budget Planner Binde r,from 30 Days to 52 Weeks,to Save $500,$5,050 and $10,000

【100 Envelope Savings System: Flexible Savings Goals】Includes 100 labeled cash envelopes and a durable binder, supporting 30-day to…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Conclusion

Think of your debt as a mountain slowly blocking your path. By climbing steadily—paying off high-interest peaks first and using small steps for the rest—you clear the way toward freedom. Each payment is like planting a flag at the summit, bringing you closer to the top. Keep your eyes on the peak, stay consistent, and soon you’ll reach the summit of financial freedom, leaving that mountain behind and enjoying the view from the top.

Debt Payoff Planner Spiral Bound Letter Size Debt Payoff Tracker 8.5×11 Inch Bill Payment Tracker Notebook Double Printed Financial Planner Monthly Expense Tracker for Credit Cards Payment 110 Pages

Comprehensive Debt Management Tool:The debt payoff planner log offers a detailed table design to help users manage debt…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Ready America 72 Hour Deluxe Emergency Kit, 2-Person 3-Day Backpack, First Aid Kit, Survival Blanket, Power Station, Emergency Food, Portable Disaster Preparedness Go-Bag for Earthquake, Fire, Flood

72-hour emergency kit for disaster preparedness: Stay prepared for emergency situations everywhere you go. Ready America emergency survival…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.