To improve your financial wellness as a freelancer, stay proactive with tax planning by keeping detailed expense records and setting aside money for quarterly payments. Automate your invoicing and savings to reduce errors and stay organized. Build an emergency fund to handle slow periods, and consider consulting a tax professional for deductions like home office costs or travel. Focusing on these strategies now can lead to long-term stability—discover more ways to secure your financial future as you continue.

Key Takeaways

- Maintain detailed records of all expenses to maximize deductions and reduce taxable income.

- Set aside a percentage of income regularly for taxes to avoid year-end surprises.

- Use digital tools to track cash flow, invoices, and expenses for better financial oversight.

- Contribute consistently to retirement accounts like IRAs or solo 401(k)s for long-term stability.

- Build an emergency fund covering 3-6 months of expenses to ensure financial resilience during slow periods.

Being a freelancer offers flexibility and independence, but it also means managing your finances can be unpredictable. Without a steady paycheck, you need to stay on top of your cash flow management to ensure your expenses are covered and your savings grow. One of the most critical aspects of financial wellness is planning for retirement, even if it feels far off. Since freelancers don’t have employer-sponsored retirement plans, you must take the initiative to set up your own. Regularly contributing to a retirement account, such as an IRA or solo 401(k), helps you build a nest egg over time and reduces the stress of uncertain income. By prioritizing retirement planning now, you ensure you’re not left scrambling when the time comes to stop working.

Freelancers must proactively plan for retirement to secure their future and manage income uncertainties effectively.

Cash flow management is the backbone of your financial stability. You should track your income and expenses diligently to understand your financial landscape. Creating a budget tailored to your fluctuating income allows you to set aside funds during busy months to cover leaner periods. Building an emergency fund—ideally covering three to six months of living expenses—can provide a safety net during slow times, preventing the need to dip into retirement savings or rack up debt. Always be mindful of your receivables; sending timely invoices and following up on overdue payments helps keep your cash flow steady. Consider setting aside a percentage of each payment specifically for taxes, so you’re not caught off guard when tax season arrives. Additionally, leveraging digital financial tools can streamline your budgeting and expense tracking processes.

Tax planning is another essential component of financial wellness. As a freelancer, you’re responsible for your taxes, which means estimated quarterly payments are necessary to avoid penalties. Keeping detailed records of all your expenses can help you maximize deductions and reduce your tax liability. Expenses like office supplies, software subscriptions, travel, and even a portion of your home office can be deducted if they’re used for work. Hiring a tax professional can save you time and money, ensuring you’re compliant and taking advantage of all available deductions. Staying organized throughout the year makes tax season less stressful and helps you avoid surprises that could disrupt your cash flow.

Ultimately, managing your finances as a freelancer requires discipline and proactive planning. Prioritize retirement planning and cash flow management to create a stable foundation. By tracking your income and expenses, saving consistently, and planning for taxes, you set yourself up for long-term financial wellness. The more deliberate you are now, the more secure your financial future will be, giving you peace of mind to focus on your work and passions without constant financial worry.

PocketCPA Smart Ledger – 50 Sheets – Sorts, Groups & Records Expenses by Category. Small Business Ledger & Organizer. Easier Bookkeeping, Expense Tracking & Tax Preparation. 8.5 x 11”. Made in USA.

A USER-FRIENDLY LEDGER THAT ORGANIZES YOUR EXPENSES by Assigning a Separate Page to Each Category of Expense.

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Frequently Asked Questions

How Can Freelancers Build an Emergency Fund Effectively?

To build an emergency fund effectively, you should start by setting aside a small portion of your income regularly. Use budgeting techniques to identify areas where you can cut expenses and redirect those savings into your fund. Implement saving strategies like automatic transfers to make consistent contributions without thinking. Over time, this disciplined approach will help you create a financial cushion that provides stability during unpredictable times.

What Are the Best Tools for Tracking Freelance Income and Expenses?

You should use tools like QuickBooks, Wave, or FreshBooks to track your freelance income and expenses efficiently. These platforms help with invoice management, making it easy to send, organize, and follow up on invoices. They also simplify expense categorization, allowing you to classify costs accurately for tax time. By leveraging these tools, you stay organized, minimize errors, and guarantee your financial records are always up-to-date.

How Often Should Freelancers Review Their Financial Goals?

You should review your financial goals regularly, quarterly or monthly, to stay aligned with your budgeting strategies and maintain financial accountability. This frequent check-in helps you adjust income targets, monitor expenses, and guarantee you’re on track for stability. By consistently evaluating your progress, you can identify opportunities for growth, catch potential issues early, and keep your financial plan dynamic and responsive to your evolving freelance workload.

What Are Common Tax Mistakes Freelancers Should Avoid?

You should avoid common tax mistakes like missing out on tax deductions and neglecting quarterly payments. Keep detailed records of expenses to maximize deductions and guarantee you’re claiming everything you’re entitled to. Additionally, make your quarterly payments on time to avoid penalties. Staying organized and proactive helps you stay compliant, save money, and reduce stress during tax season. Regularly reviewing your finances can also help you catch potential issues early.

How Can Freelancers Plan for Retirement With Irregular Income?

It might seem like a coincidence, but effective retirement planning requires you to embrace irregular income strategies. You should set aside a percentage of each paycheck, regardless of fluctuation, to build a retirement fund. Automate contributions when possible, and consider flexible accounts like IRAs or solo 401(k)s. This way, even with unpredictable income, you stay consistent, ensuring your future financial stability and peace of mind.

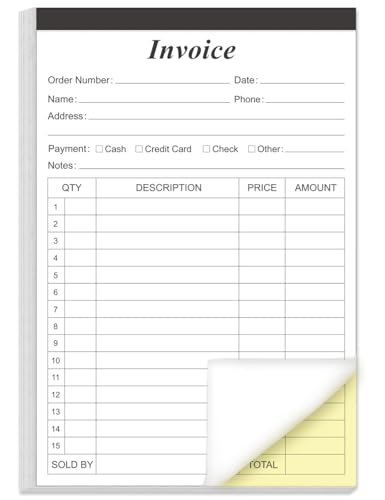

Invoice Receipt Book with Cardboard 2-Part Carbonless, 5.5" x 8.5" Order Forms, 50 Sheets Carbonless Sales Invoice Book for Small Business

PACKAGE INCLUDES – Our invoice book per pack has 50 sets sheets, Total of 100 sheets. red code…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Conclusion

As a freelancer, prioritizing your financial wellness is key to long-term stability. Remember, nearly 60% of freelancers report feeling stressed about finances—you’re not alone. By implementing smart tax tips and stability strategies, you can take control and reduce that stress. Stay proactive, keep learning, and build a solid financial foundation. Your future self will thank you for making these mindful choices today, paving the way for a more secure and confident freelancing journey.

emergency fund savings account for freelancers

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Solo 401(k): The Solopreneur's Retirement Account

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.